Blockchain

Blockchain was invented by a person using the name Satoshi Nakamoto in 2008 to serve as the public transaction ledger of the cryptocurrency bitcoin.[1] The identity of Satoshi Nakamoto is unknown. The invention of the blockchain for bitcoin made it the first digital currency to solve the double-spending problem without the need of a trusted authority or central server. The bitcoin design has inspired other applications,[1][3] and blockchains which are readable by the public are widely used by cryptocurrencies. Blockchain is considered a type of payment rail.[9] Private blockchains have been proposed for business use. Sources such as the Computerworld called the marketing of such blockchains without a proper security model "snake oil"[10]

Cryptocurrency

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets.[1][2][3]Cryptocurrencies use decentralized control as opposed to centralized digital currency and central banking systems.[4]

The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[5]

Bitcoin Trading Basics

Be sure to join my Texas Bitcoin Group on Facebook for updates!

https://www.facebook.com/groups/427421038485910

CRYPTOCURRENCIES ARE THE PRECURSOR TO WEB 3.0!

Is Web 3.0 already here? It has not been implemented widely yet. The application of Web 3.0 is limited to blockchain and cryptocurrencies. However, it is believed that in the future, it will replace Web 2.0 completely. So, let us have a look at how Web 3.0 is represented now, and how investors can benefit from it.

Money 101: Understanding the Basics of Bitcoin and Cryptocurrency

In an era where people seek greater control over their finances, Bitcoin has emerged as a powerful tool. Beyond its potential for financial empowerment, Bitcoin has proven itself as a promising investment and is increasingly regarded as the future of money.

Traditionally, stocks, bonds, and real estate have been the go-to investment choices. However, Bitcoin has made its mark as a new asset class, gaining momentum and recognition in the financial world.

But what exactly is the concept of digital gold? To draw a parallel, gold has often been likened to cryptocurrency. They share similarities: both are universal currencies not controlled by any single government, both are challenging to obtain (gold through mining, Bitcoin through complex algorithms), and both have a finite supply, lending them inherent value.

One key aspect that sets Bitcoin apart is its decentralization. Unlike traditional currencies and financial systems, Bitcoin operates on a decentralized network of peers. This means there is no central entity in control, making it resilient to government bans, regulations, and restrictions. While these measures may impact associated businesses and individuals, they cannot effectively affect the currency itself. This characteristic endows Bitcoin with a unique form of economic freedom.

Now, let's delve into the top three characteristics of cryptocurrency:

- Trustless: Bitcoin operates on a trustless system. It was designed so that no one needs to place trust in another party for transactions to occur. Trust is not a prerequisite for its functionality.

- Immutable: The term "immutable" means that something cannot be undone. With cryptocurrency's lack of centralization and trust-based elements, third-party intermediaries become unnecessary. As a result, transaction records become public and impervious to tampering.

- Decentralized: Decentralization is a core concept in the world of cryptocurrencies. It involves the removal of power from any central authority. This is a feature not found in conventional financial systems or government structures.

In conclusion, Bitcoin and cryptocurrencies offer a new perspective on money and finance. They provide opportunities for individuals to regain control over their economic destinies. As these digital assets gain momentum and recognition as legitimate investments, understanding their unique characteristics becomes crucial for anyone looking to navigate the evolving financial landscape.

Bitcoin: A Peer-to-Peer Electronic Cash System

Satoshi Nakamoto

October 31, 2008

Abstract

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

RUSH TO CRYPTO: Empowering Your Financial Future"

In my current circumstances, creating "How To" videos isn't feasible, but I've curated a selection of excellent videos to help kickstart your journey toward financial self-reliance.

The main goal of this platform is to inspire and urge you to take charge of your financial future, equipping yourself to not just survive but potentially thrive in the impending economic paradigm shift. There's a growing global skepticism surrounding the dominance of the U.S. Dollar.

I strongly recommend that you start taking steps to diversify your wealth into the world of cryptocurrency without delay. The reason for this urgency is twofold. First, there's a learning curve involved in understanding the crypto space. Second, it takes time for your bank to integrate with platforms like Coinbase, which can further delay your entry into the crypto market.

Delaying any longer may leave you in a state of economic uncertainty. Therefore, I encourage you to explore the recommended videos and start your journey toward economic empowerment and financial security in this rapidly changing financial landscape.

cryptos in exchanges or hot wallets!

On 03/17/2019 I checked my email and my two exchanges passwords were changed without my knowledge. Further research revealed my accounts had been compromised. Luckily I had my cryptos on my, cold wallet, Nano X and I did not lose my cryptos.

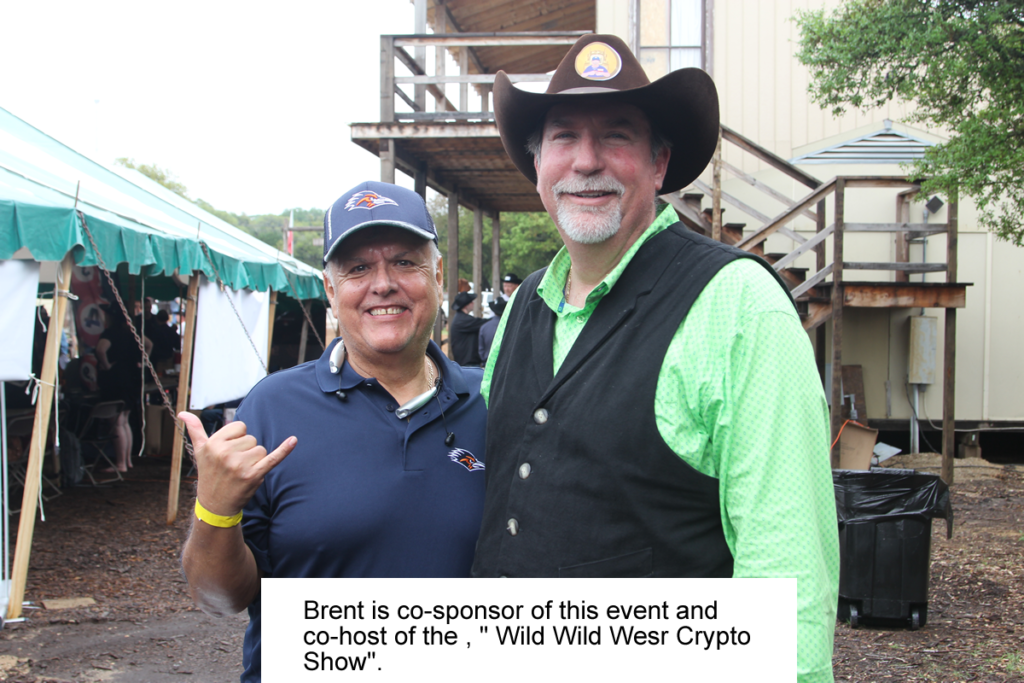

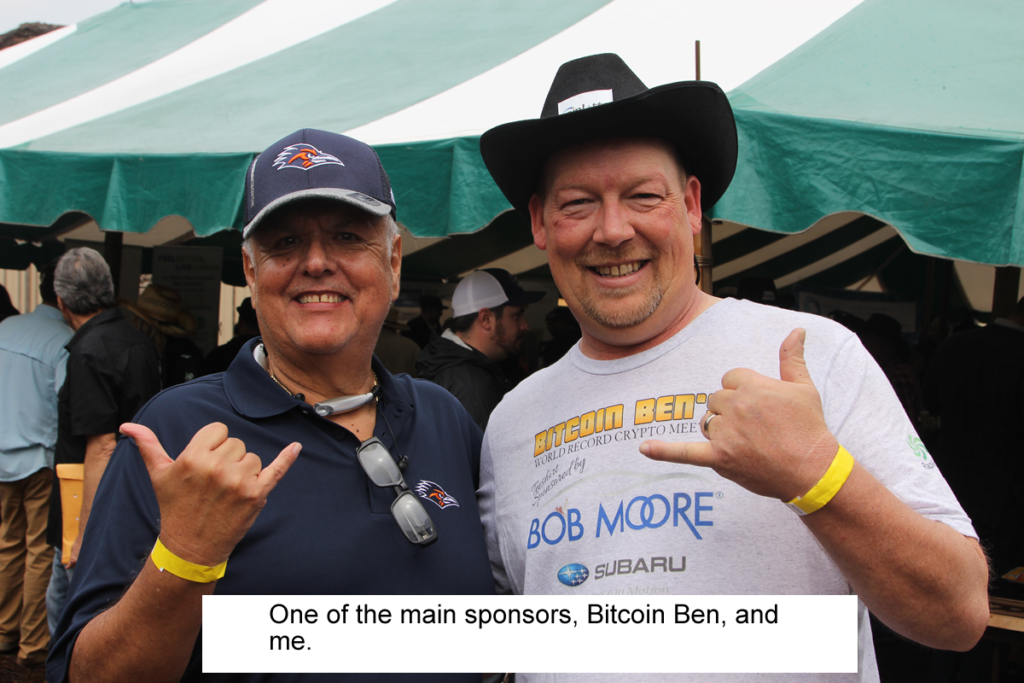

A photo of me and some Crypto friends!